The Great Divergence: Analyzing the Strategic Moats of Uber and Lyft in 2025

Date : 2026-02-19

Reading : 158

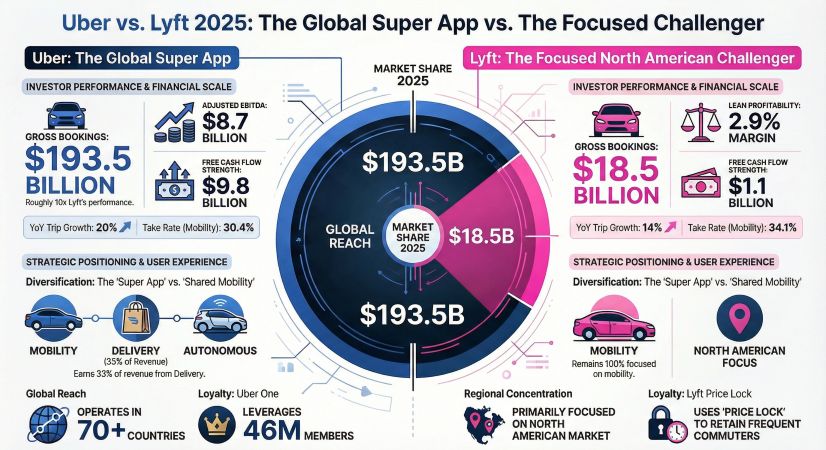

The fiscal year 2025 marks a definitive decoupling in the shared mobility sector. While headline numbers show growth for both giants, a forensic analysis of the 10-K filings reveals two fundamentally different operational realities. Uber has effectively graduated from a growth company to a cash-generating compounder, leveraging its "Super App" ecosystem to drive $9.76 billion in free cash flow. Conversely, Lyft is executing a high-stakes pivot, moving away from mass-market volume wars to defend high-margin niches through strategic M&A. At HDIN Research, we believe the critical narrative for 2025 is not just recovery, but the stark contrast in capital allocation efficiency and unit economics between the two rivals.

Figure Uber vs Lyft 2025: The Global Super App vs The Focused Challenger

Financial Health: The Reality Behind the "Record" Profits

Investors must look beyond the surface-level Net Income figures reported by both companies. In 2025, both Uber and Lyft benefited from massive, non-recurring Deferred Tax Asset (DTA) releases—$5 billion for Uber and nearly $2.9 billion for Lyft. These accounting adjustments significantly distorted Earnings Per Share (EPS).

The true story lies in liquidity and operational sustainability.

* Uber’s Capital Maturity: With a current ratio of 1.14 and positive working capital of $1.67 billion, Uber’s balance sheet is a fortress. This stability supports a massive $27 billion buyback authorization, signaling a transition to a mature capital return phase.

* Lyft’s Liquidity Strain: despite an artificially high ROE (driven by the tax benefit and high leverage), Lyft faces a current ratio of 0.65 and negative working capital. This suggests a reliance on short-term liabilities to fund operations, a risky position in a fluctuating macro environment.

Unit Economics: The "Ecosystem" vs. "Vertical" Trap

The divergence is most visible in how each dollar of revenue is generated and retained.

* Uber’s Cross-Selling Efficiency: Uber’s "Super App" synergy is no longer a buzzword; it is a quantified margin driver. With 58% of delivery users acquired organically and multi-product users spending 3x more, Uber has decoupled revenue growth from incentive spending. The platform’s ability to generate a 25% revenue jump in Delivery while expanding margins confirms the power of its diversified network effects.

* Lyft’s Insurance Burden: Lyft commands a higher revenue per ride ($6.68 vs. Uber’s $3.83), reflecting its focus on high-value North American rides. However, this pricing power is eroded by operational costs. Insurance reserves remain a volatile variable, with legislative changes (such as California’s SB 371) posing a direct threat to Lyft’s thinner margins. Unlike Uber, Lyft lacks the sheer volume density to efficiently dilute these fixed actuarial costs.

Strategic Pivots: Global Expansion and the Robotaxi Gamble

2025 saw both companies aggressively repositioning for the autonomous future, but with opposing strategies.

* Uber as the AV Aggregator: Uber is transitioning toward an asset-intensive model to secure its supply chain, evidenced by its agreement to deploy 20,000 Lucid autonomous vehicles starting in 2026. By acting as the primary demand funnel for AV hardware, Uber is building a defensive moat against disintermediation.

* Lyft’s Defensive M&A: Recognizing the limits of organic growth in North America, Lyft has turned to inorganic expansion. The acquisition of Freenow (Europe) and TBR (Global Corporate Travel) signals a retreat from the commoditized mass market toward "white-glove" premium services and corporate contracts—a necessary move to insulate its margins from Uber’s scale pricing.

HDIN Viewpoint

At HDIN Research, we assess that the era of direct head-to-head competition between Uber and Lyft has ended. Uber has achieved "escape velocity," utilizing its Advertising and Membership (Uber One) engines to subsidize core operations and generate superior free cash flow. It is now a defensive utility with tech-like margins.

Lyft, however, is entering a critical "turnaround and restructure" phase. Its survival depends not on matching Uber’s scale, but on the successful integration of its European acquisitions and the "Price Lock" subscription model to stabilize churn. Investors should closely monitor Uber’s advertising revenue growth as a pure-profit lever, while scrutinizing Lyft’s ability to manage its liquidity ratios over the next four quarters.

Presentation Download

For a comprehensive breakdown of the valuation models, detailed DuPont analysis, and the specific impact of the 2025 DTA releases on valuation metrics, please refer to our full presentation.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

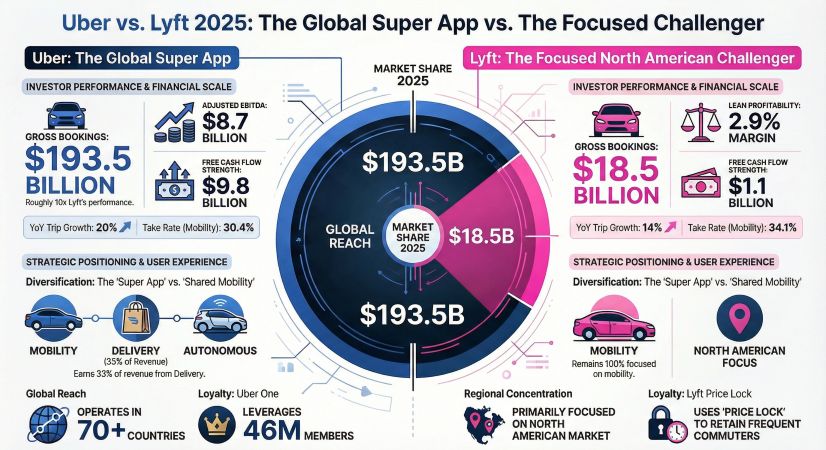

Figure Uber vs Lyft 2025: The Global Super App vs The Focused Challenger

Financial Health: The Reality Behind the "Record" Profits

Investors must look beyond the surface-level Net Income figures reported by both companies. In 2025, both Uber and Lyft benefited from massive, non-recurring Deferred Tax Asset (DTA) releases—$5 billion for Uber and nearly $2.9 billion for Lyft. These accounting adjustments significantly distorted Earnings Per Share (EPS).

The true story lies in liquidity and operational sustainability.

* Uber’s Capital Maturity: With a current ratio of 1.14 and positive working capital of $1.67 billion, Uber’s balance sheet is a fortress. This stability supports a massive $27 billion buyback authorization, signaling a transition to a mature capital return phase.

* Lyft’s Liquidity Strain: despite an artificially high ROE (driven by the tax benefit and high leverage), Lyft faces a current ratio of 0.65 and negative working capital. This suggests a reliance on short-term liabilities to fund operations, a risky position in a fluctuating macro environment.

Unit Economics: The "Ecosystem" vs. "Vertical" Trap

The divergence is most visible in how each dollar of revenue is generated and retained.

* Uber’s Cross-Selling Efficiency: Uber’s "Super App" synergy is no longer a buzzword; it is a quantified margin driver. With 58% of delivery users acquired organically and multi-product users spending 3x more, Uber has decoupled revenue growth from incentive spending. The platform’s ability to generate a 25% revenue jump in Delivery while expanding margins confirms the power of its diversified network effects.

* Lyft’s Insurance Burden: Lyft commands a higher revenue per ride ($6.68 vs. Uber’s $3.83), reflecting its focus on high-value North American rides. However, this pricing power is eroded by operational costs. Insurance reserves remain a volatile variable, with legislative changes (such as California’s SB 371) posing a direct threat to Lyft’s thinner margins. Unlike Uber, Lyft lacks the sheer volume density to efficiently dilute these fixed actuarial costs.

Strategic Pivots: Global Expansion and the Robotaxi Gamble

2025 saw both companies aggressively repositioning for the autonomous future, but with opposing strategies.

* Uber as the AV Aggregator: Uber is transitioning toward an asset-intensive model to secure its supply chain, evidenced by its agreement to deploy 20,000 Lucid autonomous vehicles starting in 2026. By acting as the primary demand funnel for AV hardware, Uber is building a defensive moat against disintermediation.

* Lyft’s Defensive M&A: Recognizing the limits of organic growth in North America, Lyft has turned to inorganic expansion. The acquisition of Freenow (Europe) and TBR (Global Corporate Travel) signals a retreat from the commoditized mass market toward "white-glove" premium services and corporate contracts—a necessary move to insulate its margins from Uber’s scale pricing.

HDIN Viewpoint

At HDIN Research, we assess that the era of direct head-to-head competition between Uber and Lyft has ended. Uber has achieved "escape velocity," utilizing its Advertising and Membership (Uber One) engines to subsidize core operations and generate superior free cash flow. It is now a defensive utility with tech-like margins.

Lyft, however, is entering a critical "turnaround and restructure" phase. Its survival depends not on matching Uber’s scale, but on the successful integration of its European acquisitions and the "Price Lock" subscription model to stabilize churn. Investors should closely monitor Uber’s advertising revenue growth as a pure-profit lever, while scrutinizing Lyft’s ability to manage its liquidity ratios over the next four quarters.

Presentation Download

For a comprehensive breakdown of the valuation models, detailed DuPont analysis, and the specific impact of the 2025 DTA releases on valuation metrics, please refer to our full presentation.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com