Caterpillar vs. Terex: The Strategic Divergence Between "Nuclear" Scale and Niche Agility

Date : 2026-02-20

Reading : 103

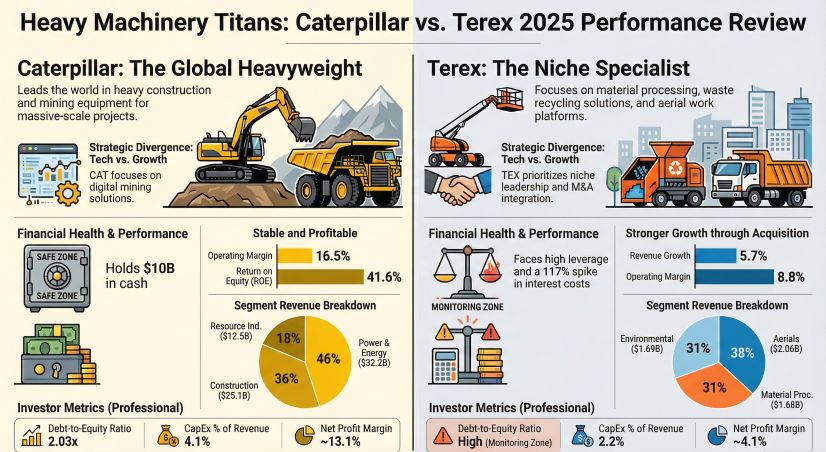

The 2025 financial disclosures reveal a fundamental bifurcation in the heavy machinery sector. While Caterpillar (CAT) leverages a "nuclear-powered" balance sheet and vertical integration to absorb macroeconomic shocks, Terex (Terex) is executing a high-stakes structural pivot to escape deep cyclicality. HDIN Research identifies that while Caterpillar dominates through a 41.7% Return on Equity (ROE) driven by pricing power, Terex is redefining its valuation logic by shifting exposure from construction cycles to municipal infrastructure resilience.

Figure Heavy Machinery Titans: Caterpillar vs Terex 2025 Performance Review

Financial Health: The "Value Moat" vs. The "Leverage Bet"

Financial Health: The "Value Moat" vs. The "Leverage Bet"

The DuPont analysis conducted by HDIN Research highlights a stark contrast in capital efficiency and resilience.

Caterpillar: The Profit Fortress

Caterpillar demonstrated exceptional pricing power in 2025. Despite facing $1.13 billion in unfavorable price realization within its Construction Industries, the segment maintained a robust 18.7% operating margin. This resilience is underpinned by a massive $51.2 billion backlog and a services-led strategy that acts as a strategic ballast.

* The "So What": Caterpillar is not merely selling iron; it is monetizing uptime. With $10 billion in cash and a sophisticated "match-funding" model via Cat Financial, CAT absorbs tariff shocks (projected at $2.6 billion) through sheer scale and hedging, maintaining a "Safe Zone" liquidity profile.

Terex: The Transformation Stress Test

Conversely, Terex’s financials reflect the friction of transformation. The core Aerials segment saw margins collapse from 11.2% to 5.0% due to inventory destocking and high interest rate sensitivity.

* The "So What": Terex is currently in a "Grey Zone" regarding financial flexibility. The aggressive acquisition of ESG and the merger with REV Group have spiked interest expenses by 117%. Terex is trading short-term margin compression for long-term portfolio optimization, betting that future cash flows from waste and utility sectors will service the increased leverage.

Strategic Pivots: Energy Dominance vs. Anti-Cyclical Niches

Our analysis of the business structures reveals two distinct pathways for growth in a volatile global economy.

CAT: Deepening the Resource Monopoly

Caterpillar remains unapologetically committed to heavy industry. By integrating the Rail business into Resource Industries in 2026, CAT is doubling down on the energy transition and mining super-cycle. Its strategy is "Tech-Enabled Hardware"—using autonomy and digitization to lock in mining customers who require massive output, a domain where Terex effectively does not compete.

TEX: The Municipal Sanctuary

Terex is pivoting away from the volatility of general construction. By acquiring Environmental Solutions (ESG) and merging with REV Group (ambulances, fire trucks), Terex is constructing a portfolio driven by public service budgets rather than private capital expenditure.

* Strategic Implication: This is a move to decouple from the boom-and-bust commodity cycles that drive Caterpillar, aiming instead for the steady, low-beta returns of government-backed infrastructure and waste management.

Risk Management: Systemic Defense vs. Structural Avoidance

How these giants handle geopolitical and supply chain risks offers a lesson in corporate governance.

* Caterpillar (Systemic Defense): CAT manages risk through a global strategic sourcing model and financial hedging. It treats tariffs and supply chain disruptions as variables to be quantified and offset via "Price Realization."

* Terex (Structural Avoidance): Terex manages risk by changing the playing field. Recognizing the vulnerability of its "Aerials" business to interest rates, it is diversifying into sectors (Environmental/Utilities) that are essential services, theoretically immune to economic downturns. However, HDIN Research notes that Terex faces specific supply chain risks, particularly regarding single-source dependencies for vehicle chassis.

HDIN Viewpoint: The Investor's Dilemma

At HDIN Research, we view the 2026 outlook as a test of two opposing philosophies.

Caterpillar represents the "Compounder": A heavy-asset juggernaut that generates cash flow through installed base density and aftermarket services. Its governance structure ensures stability, making it a defensive play against inflation and supply chain fragmentation.

Terex represents the "Transformer": It is currently a "show-me" story. The company must prove that the integration of REV and ESG can generate sufficient free cash flow to deleverage the balance sheet. If successful, Terex will re-rate as a resilient industrial technology firm; if not, the weight of its debt amidst a softening aerials market could constrain its strategic options.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report, including the detailed DuPont Analysis and debt-maturity profiles.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

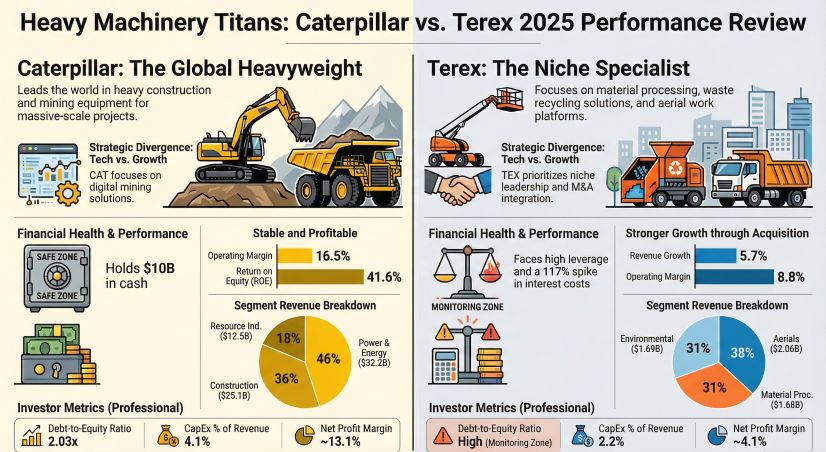

Figure Heavy Machinery Titans: Caterpillar vs Terex 2025 Performance Review

Financial Health: The "Value Moat" vs. The "Leverage Bet"

Financial Health: The "Value Moat" vs. The "Leverage Bet"The DuPont analysis conducted by HDIN Research highlights a stark contrast in capital efficiency and resilience.

Caterpillar: The Profit Fortress

Caterpillar demonstrated exceptional pricing power in 2025. Despite facing $1.13 billion in unfavorable price realization within its Construction Industries, the segment maintained a robust 18.7% operating margin. This resilience is underpinned by a massive $51.2 billion backlog and a services-led strategy that acts as a strategic ballast.

* The "So What": Caterpillar is not merely selling iron; it is monetizing uptime. With $10 billion in cash and a sophisticated "match-funding" model via Cat Financial, CAT absorbs tariff shocks (projected at $2.6 billion) through sheer scale and hedging, maintaining a "Safe Zone" liquidity profile.

Terex: The Transformation Stress Test

Conversely, Terex’s financials reflect the friction of transformation. The core Aerials segment saw margins collapse from 11.2% to 5.0% due to inventory destocking and high interest rate sensitivity.

* The "So What": Terex is currently in a "Grey Zone" regarding financial flexibility. The aggressive acquisition of ESG and the merger with REV Group have spiked interest expenses by 117%. Terex is trading short-term margin compression for long-term portfolio optimization, betting that future cash flows from waste and utility sectors will service the increased leverage.

Strategic Pivots: Energy Dominance vs. Anti-Cyclical Niches

Our analysis of the business structures reveals two distinct pathways for growth in a volatile global economy.

CAT: Deepening the Resource Monopoly

Caterpillar remains unapologetically committed to heavy industry. By integrating the Rail business into Resource Industries in 2026, CAT is doubling down on the energy transition and mining super-cycle. Its strategy is "Tech-Enabled Hardware"—using autonomy and digitization to lock in mining customers who require massive output, a domain where Terex effectively does not compete.

TEX: The Municipal Sanctuary

Terex is pivoting away from the volatility of general construction. By acquiring Environmental Solutions (ESG) and merging with REV Group (ambulances, fire trucks), Terex is constructing a portfolio driven by public service budgets rather than private capital expenditure.

* Strategic Implication: This is a move to decouple from the boom-and-bust commodity cycles that drive Caterpillar, aiming instead for the steady, low-beta returns of government-backed infrastructure and waste management.

Risk Management: Systemic Defense vs. Structural Avoidance

How these giants handle geopolitical and supply chain risks offers a lesson in corporate governance.

* Caterpillar (Systemic Defense): CAT manages risk through a global strategic sourcing model and financial hedging. It treats tariffs and supply chain disruptions as variables to be quantified and offset via "Price Realization."

* Terex (Structural Avoidance): Terex manages risk by changing the playing field. Recognizing the vulnerability of its "Aerials" business to interest rates, it is diversifying into sectors (Environmental/Utilities) that are essential services, theoretically immune to economic downturns. However, HDIN Research notes that Terex faces specific supply chain risks, particularly regarding single-source dependencies for vehicle chassis.

HDIN Viewpoint: The Investor's Dilemma

At HDIN Research, we view the 2026 outlook as a test of two opposing philosophies.

Caterpillar represents the "Compounder": A heavy-asset juggernaut that generates cash flow through installed base density and aftermarket services. Its governance structure ensures stability, making it a defensive play against inflation and supply chain fragmentation.

Terex represents the "Transformer": It is currently a "show-me" story. The company must prove that the integration of REV and ESG can generate sufficient free cash flow to deleverage the balance sheet. If successful, Terex will re-rate as a resilient industrial technology firm; if not, the weight of its debt amidst a softening aerials market could constrain its strategic options.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report, including the detailed DuPont Analysis and debt-maturity profiles.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com