Big Tobacco’s 2025 Divergence: Strategic Moats & The Race for Smoke-Free Dominance

Date : 2026-02-20

Reading : 75

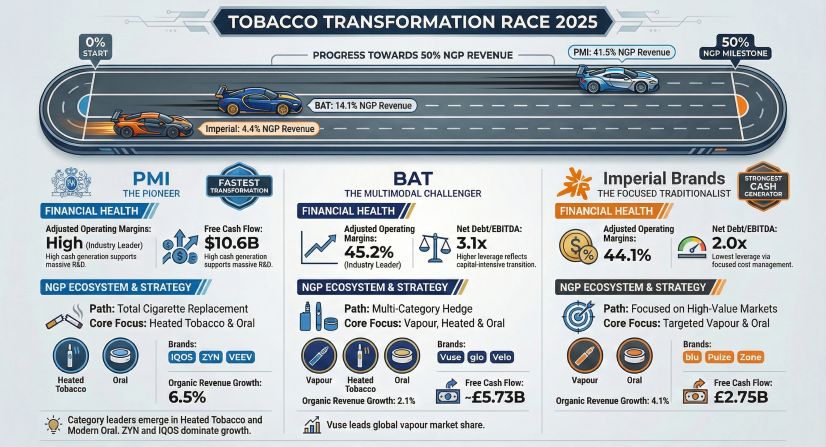

The fiscal year 2025 marked a definitive fracture in the global tobacco industry’s monolithic structure. No longer can "Big Tobacco" be viewed as a uniform sector managing decline; instead, the 2025 annual reports of Philip Morris International (PMI), British American Tobacco (BAT), and Imperial Brands (IMB) reveal three distinct business models competing for the future of nicotine.

According to HDIN Research’s analysis of the latest financial disclosures, the industry has split into technological disruptors and cash-flow defenders. While PMI has effectively crossed the "transformation singularity" with Next-Generation Products (NGP) accounting for 41.5% of revenue, BAT and Imperial Brands are executing sophisticated hedging strategies to protect legacy margins while navigating the turbulent shift away from combustibles.

Figure Tobacco Transformation Race 2025

The "Replacement" vs. "Hedging" Paradigm

The "Replacement" vs. "Hedging" Paradigm

The most critical takeaway from the 2025 data is the fundamental difference in strategic intent.

PMI: The Cannibalization Strategy

PMI is no longer a tobacco company in the traditional sense; it has evolved into a technology-driven nicotine delivery firm. With a gross margin of 67.1% and NGP revenues hitting $16.85 billion, PMI is proving that self-cannibalization is a viable path to growth. Their strategy is not to manage the decline of cigarettes but to accelerate their obsolescence through "The Replacement Strategy." The firm’s capital allocation reflects this, with effectively 100% of R&D expenditure directed toward smoke-free portfolios like IQOS and ZYN.

BAT & Imperial: The Margin Defense

Conversely, BAT and Imperial Brands are playing a game of "Managed Transition."

* BAT remains a multi-category hedger. While it holds the global leadership in vaping (Vuse) and a strong second place in modern oral (Velo), it still relies on combustibles for 78.9% of its revenue to fund these ventures. The challenge for BAT, as noted in 2025 data, is the "profit paradox": despite holding a 51.7% value share in the US tracked vape market, revenue in that segment dipped due to the siege of illicit single-use products.

* Imperial Brands has adopted a "Challenger Strategy," prioritizing capital efficiency over broad expansion. By focusing 70% of profits on five priority markets and maintaining a lean net debt/EBITDA ratio of 2.0x, Imperial has positioned itself as a defensive yield haven rather than a tech growth stock.

The Battle for the US Profit Pool

The United States remains the industry's most vital financial reservoir, but the dynamics of profitability are shifting.

HDIN Research notes a significant vulnerability in BAT’s reliance on the US, which contributes over 56% of its operating profit. While BAT defends its position through price increases (+12.3% price/mix), PMI is aggressively flanking the market. Through the acquisition of Swedish Match (ZYN) and the re-acquisition of IQOS commercial rights, PMI is building a "profit sanctuary" in the US oral nicotine market—a sector with high retention rates and devoid of the regulatory chaos plaguing the vaping sector.

Capital Allocation: Growth vs. Yield

The divergence is equally visible in how these giants utilize cash:

* PMI is reinvesting for a post-cigarette world, having deployed over $16 billion in cumulative R&D since 2008.

* Imperial Brands prioritizes immediate shareholder returns, executing a "constant buyback" model (£1.25bn in 2025) that appeals to value investors seeking safety.

* BAT attempts to balance both, aiming for a 50% smoke-free revenue target by 2035 while managing a higher leverage profile (3.1x) compared to its peers.

HDIN Viewpoint: The Valuation Gap Will Widen

At HDIN Research, we believe the market is moving toward a permanent re-rating of these equities based on their "Tech vs. Legacy" profile.

Our analysis suggests that PMI has successfully decoupled its financial health from the volume decline of combustible cigarettes. By achieving a "critical mass" in smoke-free revenue (>40%), PMI is poised to trade at growth-tech multiples. In contrast, BAT and Imperial Brands will likely be valued on their ability to act as "Cash Cows"—generating massive, reliable dividends from legacy portfolios while effectively managing regulatory tail risks.

The winner of the next decade will not necessarily be the company with the highest volume, but the one with the most resilient "retention ecosystem." Currently, PMI’s closed-loop system of IQOS (device + consumable) and ZYN (high-frequency oral usage) offers a deeper strategic moat than the open-system vaping markets where BAT currently fights for share against illicit competition.

Download the Full Strategic Analysis

This article provides only a snapshot of the deep-dive metrics available in our full report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

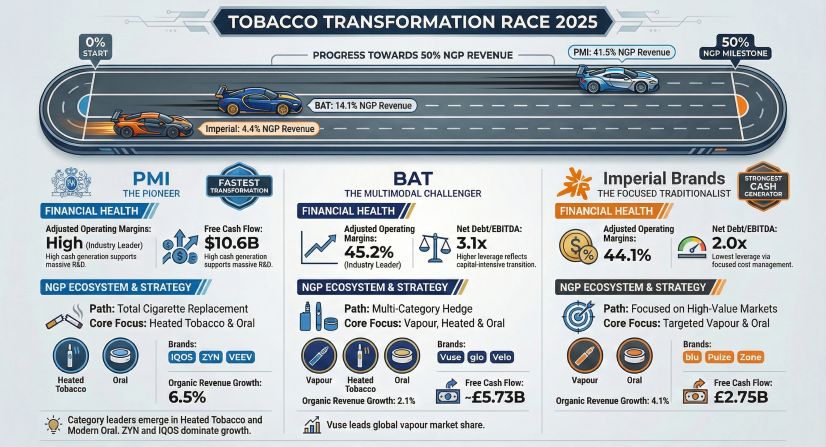

According to HDIN Research’s analysis of the latest financial disclosures, the industry has split into technological disruptors and cash-flow defenders. While PMI has effectively crossed the "transformation singularity" with Next-Generation Products (NGP) accounting for 41.5% of revenue, BAT and Imperial Brands are executing sophisticated hedging strategies to protect legacy margins while navigating the turbulent shift away from combustibles.

Figure Tobacco Transformation Race 2025

The "Replacement" vs. "Hedging" Paradigm

The "Replacement" vs. "Hedging" ParadigmThe most critical takeaway from the 2025 data is the fundamental difference in strategic intent.

PMI: The Cannibalization Strategy

PMI is no longer a tobacco company in the traditional sense; it has evolved into a technology-driven nicotine delivery firm. With a gross margin of 67.1% and NGP revenues hitting $16.85 billion, PMI is proving that self-cannibalization is a viable path to growth. Their strategy is not to manage the decline of cigarettes but to accelerate their obsolescence through "The Replacement Strategy." The firm’s capital allocation reflects this, with effectively 100% of R&D expenditure directed toward smoke-free portfolios like IQOS and ZYN.

BAT & Imperial: The Margin Defense

Conversely, BAT and Imperial Brands are playing a game of "Managed Transition."

* BAT remains a multi-category hedger. While it holds the global leadership in vaping (Vuse) and a strong second place in modern oral (Velo), it still relies on combustibles for 78.9% of its revenue to fund these ventures. The challenge for BAT, as noted in 2025 data, is the "profit paradox": despite holding a 51.7% value share in the US tracked vape market, revenue in that segment dipped due to the siege of illicit single-use products.

* Imperial Brands has adopted a "Challenger Strategy," prioritizing capital efficiency over broad expansion. By focusing 70% of profits on five priority markets and maintaining a lean net debt/EBITDA ratio of 2.0x, Imperial has positioned itself as a defensive yield haven rather than a tech growth stock.

The Battle for the US Profit Pool

The United States remains the industry's most vital financial reservoir, but the dynamics of profitability are shifting.

HDIN Research notes a significant vulnerability in BAT’s reliance on the US, which contributes over 56% of its operating profit. While BAT defends its position through price increases (+12.3% price/mix), PMI is aggressively flanking the market. Through the acquisition of Swedish Match (ZYN) and the re-acquisition of IQOS commercial rights, PMI is building a "profit sanctuary" in the US oral nicotine market—a sector with high retention rates and devoid of the regulatory chaos plaguing the vaping sector.

Capital Allocation: Growth vs. Yield

The divergence is equally visible in how these giants utilize cash:

* PMI is reinvesting for a post-cigarette world, having deployed over $16 billion in cumulative R&D since 2008.

* Imperial Brands prioritizes immediate shareholder returns, executing a "constant buyback" model (£1.25bn in 2025) that appeals to value investors seeking safety.

* BAT attempts to balance both, aiming for a 50% smoke-free revenue target by 2035 while managing a higher leverage profile (3.1x) compared to its peers.

HDIN Viewpoint: The Valuation Gap Will Widen

At HDIN Research, we believe the market is moving toward a permanent re-rating of these equities based on their "Tech vs. Legacy" profile.

Our analysis suggests that PMI has successfully decoupled its financial health from the volume decline of combustible cigarettes. By achieving a "critical mass" in smoke-free revenue (>40%), PMI is poised to trade at growth-tech multiples. In contrast, BAT and Imperial Brands will likely be valued on their ability to act as "Cash Cows"—generating massive, reliable dividends from legacy portfolios while effectively managing regulatory tail risks.

The winner of the next decade will not necessarily be the company with the highest volume, but the one with the most resilient "retention ecosystem." Currently, PMI’s closed-loop system of IQOS (device + consumable) and ZYN (high-frequency oral usage) offers a deeper strategic moat than the open-system vaping markets where BAT currently fights for share against illicit competition.

Download the Full Strategic Analysis

This article provides only a snapshot of the deep-dive metrics available in our full report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com