The Great Bifurcation: Bloom Energy’s AI Ascent vs. FuelCell Energy’s Strategic Retrenchment

Date : 2026-02-20

Reading : 87

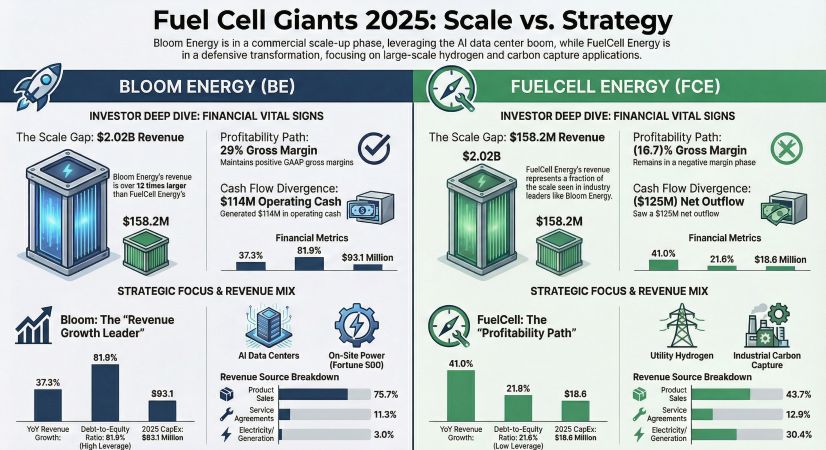

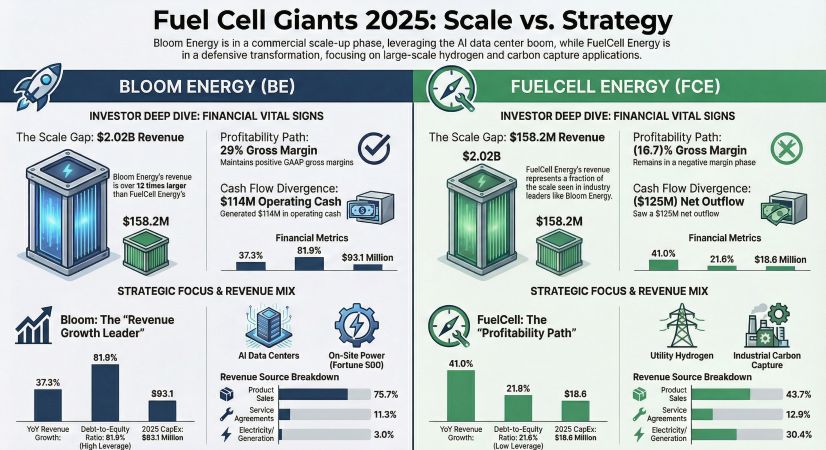

The fiscal year 2025 has marked a definitive bifurcation in the hydrogen and fuel cell sector. According to an in-depth analysis by HDIN Research, the industry is no longer a monolithic block of "clean energy potential." Instead, it has split into two distinct commercial realities: Bloom Energy (BE) has successfully leveraged the AI data center boom to achieve operational scale, while FuelCell Energy (FCE) has entered a period of defensive restructuring and technological narrowing.

The contrast is starkest in the top-line figures. Bloom Energy reported $2.02 billion in revenue—more than 12 times the size of FuelCell Energy’s $158 million. However, the raw numbers merely obscure the deeper strategic story: the transition from "science project" economics to industrial viability.

Figure Fuel Cell Giants 2025 Scale vs Strategy

Financial Health: The Arrival of Positive Cash Flow

Financial Health: The Arrival of Positive Cash Flow

For years, the fuel cell industry has been plagued by cash burn. 2025 marked a pivotal turning point for Bloom Energy. By achieving $114 million in positive operating cash flow, Bloom has demonstrated that its unit economics can support self-funded growth.

This financial stability is underpinned by a robust gross margin profile. Bloom achieved a GAAP gross margin of 29% (and nearly 35% on product sales alone). This suggests that Bloom has successfully navigated the "manufacturing hell" phase, utilizing automation and supply chain maturity to lower material costs for its Solid Oxide Fuel Cell (SOFC) platform.

Conversely, FuelCell Energy faces significant headwinds. With a negative gross margin of -16.7% and a manufacturing variance of over $13 million, FCE is still struggling to amortize high fixed costs over low production volumes. While FCE maintains a safety net of $278 million in cash, its negative operating cash flow ($125 million outflow) necessitates a heavy reliance on external capital, differentiating it sharply from Bloom’s growing financial autonomy.

Strategic Pivots: "Time to Power" vs. Carbon Abatement

The revenue divergence is a direct result of market positioning.

Bloom Energy: The AI Infrastructure Play

Bloom has effectively repositioned itself as a critical enabler of the AI revolution. Data centers and "hyperscalers" are facing a power crisis, with traditional grid upgrades taking years. Bloom’s "Time to Power" value proposition—deploying microgrids in months rather than years—has become its primary commercial moat.

* Capacity Expansion: Bloom is aggressively expanding, targeting a 2 GW manufacturing capacity by 2026 to meet this surge in demand.

* Grid Independence: The ability to run in "island mode" creates high-reliability value for semiconductor and tech clients who cannot afford milliseconds of downtime.

FuelCell Energy: The Specialized Industrial Play

FCE has pivoted away from broad solid oxide power generation to focus on its unique strength: Molten Carbonate (MCFC) technology. Unlike SOFC, carbonate fuel cells can concentrate and capture CO2 from external exhaust streams.

* The "Tri-gen" Niche: FCE’s success with the Toyota Long Beach project—simultaneously producing power, hydrogen, and water—validates its technology in complex industrial setups.

* Exxon Mobil Partnership: FCE’s future growth is now heavily tied to carbon capture pilots (like the Rotterdam project) rather than general power generation.

Manufacturing & Operational Efficiency

The "So What" regarding manufacturing capability is critical for investors. Bloom Energy’s ability to stabilize product margins at 35% indicates a mature industrial learning curve. They are no longer just proving the science; they are optimizing the factory floor.

In contrast, FuelCell Energy’s strategic decision in 2025 to halt its solid oxide power generation development and reduce its workforce by 39% signals a "shrink to grow" strategy. By focusing strictly on Carbonate technology and Carbon Capture, FCE is attempting to reduce cash burn, but this limits their addressable market compared to Bloom’s broad platform application.

HDIN Research Viewpoint

At HDIN Research, we believe the 2025 data signals a fundamental shift in how the market should value these assets.

* Bloom Energy has graduated from a "CleanTech speculative play" to an "AI Infrastructure Growth" asset. Their challenge is no longer technology risk, but execution risk—specifically, managing a massive inventory ramp-up and debt load (over $2.6 billion) to satisfy the insatiable power appetite of the digital economy.

* FuelCell Energy remains a "Deep Tech/Special Situations" asset. Their moat is narrow but deep. If global policy aggressively incentivizes industrial carbon capture (e.g., via 45Q tax credits), FCE’s proprietary carbonate technology offers a solution that standard batteries or solar cannot provide. However, without a massive partner scale-up, they remain vulnerable to liquidity pressures.

The Verdict: 2025 proved that scale matters. Bloom has crossed the chasm to commercial viability, while FuelCell Energy fights to define its niche in a decarbonizing world.

Access the Full Analysis

To explore the granular data, including detailed margin breakdowns, debt maturity profiles, and specific project timelines for the Toyota and Exxon collaborations, please download the full presentation.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

The contrast is starkest in the top-line figures. Bloom Energy reported $2.02 billion in revenue—more than 12 times the size of FuelCell Energy’s $158 million. However, the raw numbers merely obscure the deeper strategic story: the transition from "science project" economics to industrial viability.

Figure Fuel Cell Giants 2025 Scale vs Strategy

Financial Health: The Arrival of Positive Cash Flow

Financial Health: The Arrival of Positive Cash FlowFor years, the fuel cell industry has been plagued by cash burn. 2025 marked a pivotal turning point for Bloom Energy. By achieving $114 million in positive operating cash flow, Bloom has demonstrated that its unit economics can support self-funded growth.

This financial stability is underpinned by a robust gross margin profile. Bloom achieved a GAAP gross margin of 29% (and nearly 35% on product sales alone). This suggests that Bloom has successfully navigated the "manufacturing hell" phase, utilizing automation and supply chain maturity to lower material costs for its Solid Oxide Fuel Cell (SOFC) platform.

Conversely, FuelCell Energy faces significant headwinds. With a negative gross margin of -16.7% and a manufacturing variance of over $13 million, FCE is still struggling to amortize high fixed costs over low production volumes. While FCE maintains a safety net of $278 million in cash, its negative operating cash flow ($125 million outflow) necessitates a heavy reliance on external capital, differentiating it sharply from Bloom’s growing financial autonomy.

Strategic Pivots: "Time to Power" vs. Carbon Abatement

The revenue divergence is a direct result of market positioning.

Bloom Energy: The AI Infrastructure Play

Bloom has effectively repositioned itself as a critical enabler of the AI revolution. Data centers and "hyperscalers" are facing a power crisis, with traditional grid upgrades taking years. Bloom’s "Time to Power" value proposition—deploying microgrids in months rather than years—has become its primary commercial moat.

* Capacity Expansion: Bloom is aggressively expanding, targeting a 2 GW manufacturing capacity by 2026 to meet this surge in demand.

* Grid Independence: The ability to run in "island mode" creates high-reliability value for semiconductor and tech clients who cannot afford milliseconds of downtime.

FuelCell Energy: The Specialized Industrial Play

FCE has pivoted away from broad solid oxide power generation to focus on its unique strength: Molten Carbonate (MCFC) technology. Unlike SOFC, carbonate fuel cells can concentrate and capture CO2 from external exhaust streams.

* The "Tri-gen" Niche: FCE’s success with the Toyota Long Beach project—simultaneously producing power, hydrogen, and water—validates its technology in complex industrial setups.

* Exxon Mobil Partnership: FCE’s future growth is now heavily tied to carbon capture pilots (like the Rotterdam project) rather than general power generation.

Manufacturing & Operational Efficiency

The "So What" regarding manufacturing capability is critical for investors. Bloom Energy’s ability to stabilize product margins at 35% indicates a mature industrial learning curve. They are no longer just proving the science; they are optimizing the factory floor.

In contrast, FuelCell Energy’s strategic decision in 2025 to halt its solid oxide power generation development and reduce its workforce by 39% signals a "shrink to grow" strategy. By focusing strictly on Carbonate technology and Carbon Capture, FCE is attempting to reduce cash burn, but this limits their addressable market compared to Bloom’s broad platform application.

HDIN Research Viewpoint

At HDIN Research, we believe the 2025 data signals a fundamental shift in how the market should value these assets.

* Bloom Energy has graduated from a "CleanTech speculative play" to an "AI Infrastructure Growth" asset. Their challenge is no longer technology risk, but execution risk—specifically, managing a massive inventory ramp-up and debt load (over $2.6 billion) to satisfy the insatiable power appetite of the digital economy.

* FuelCell Energy remains a "Deep Tech/Special Situations" asset. Their moat is narrow but deep. If global policy aggressively incentivizes industrial carbon capture (e.g., via 45Q tax credits), FCE’s proprietary carbonate technology offers a solution that standard batteries or solar cannot provide. However, without a massive partner scale-up, they remain vulnerable to liquidity pressures.

The Verdict: 2025 proved that scale matters. Bloom has crossed the chasm to commercial viability, while FuelCell Energy fights to define its niche in a decarbonizing world.

Access the Full Analysis

To explore the granular data, including detailed margin breakdowns, debt maturity profiles, and specific project timelines for the Toyota and Exxon collaborations, please download the full presentation.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com