Hyundai Pharmaceutical FY2025: Profit Surge Meets Liquidity Constraints

Date : 2026-02-20

Reading : 97

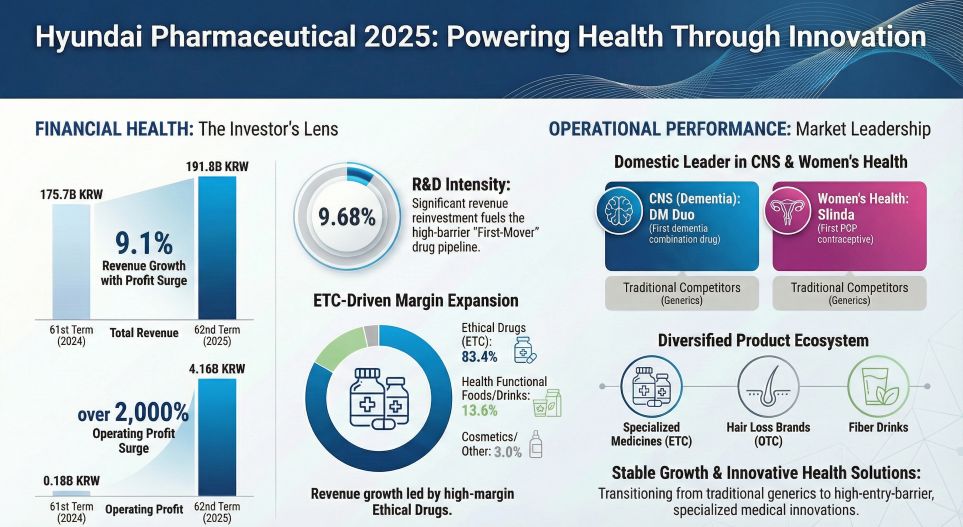

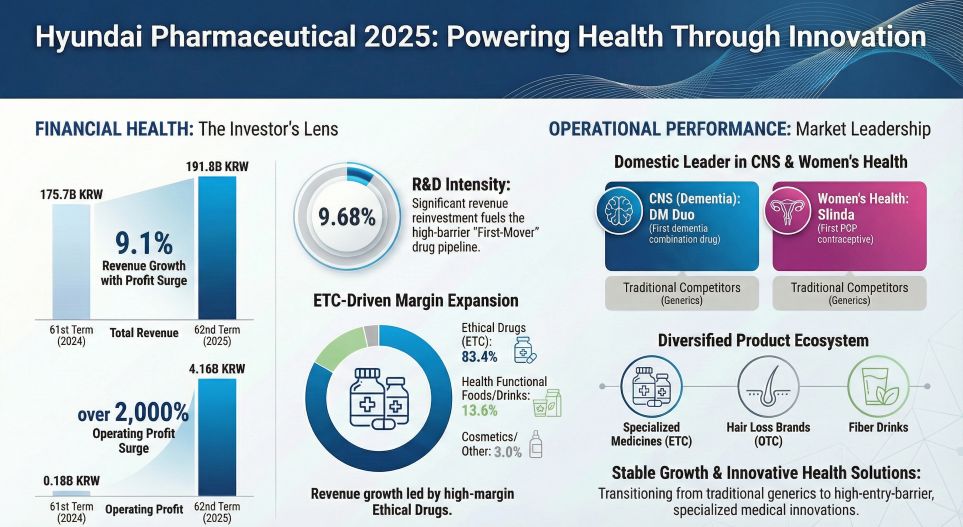

Hyundai Pharmaceutical (Hyundai Pharm) has delivered a striking financial turnaround in its 62nd fiscal period (Dec 2024 – Nov 2025), posting a 2,218% explosion in operating profit (KRW 4.16 billion). While headline numbers suggest a simple recovery, HDIN Research analysis reveals a deeper structural shift: the company is successfully transitioning from low-margin generics to high-barrier "First-in-Class" and "First-mover" assets. However, this operational success is currently juxtaposed against a critical liquidity tighten, raising strategic questions about capital allocation for the upcoming fiscal year.

Figure Hyundai Pharmaceutical 2025 Powering Health Through Innovation

The "First-Mover" Advantage: Margin Expansion over Volume

The "First-Mover" Advantage: Margin Expansion over Volume

The 11% year-over-year growth in the pharmaceutical division (reaching KRW 159.8 billion) was not driven by legacy volume but by the successful commercialization of differentiated assets with high entry barriers.

Slinda (Progesterone-Only Pill): As Korea’s first estrogen-free contraceptive, Slinda has capitalized on a void in the market for patients sensitive to estrogen. By securing a monopoly in this specific therapeutic sub-segment, Hyundai Pharm has moved beyond price wars typical of the oral contraceptive market.

DM Duo (Donepezil + Memantine): Launching as the first domestic composite formulation for Alzheimer’s, DM Duo addresses compliance issues in elderly patients. By combining two standard-of-care mechanisms, the company secured premium reimbursement pricing, significantly lifting the gross margin profile compared to single-agent generics.

The Strategic Implication: The revenue contribution of these two assets alone is projected to reach KRW 15–20 billion in the next cycle. This confirms that the company’s strategy to optimize its portfolio structure—replacing low-margin products with exclusive modified drugs—is paying off.

R&D Pivot: The Cost of Ambition

Hyundai Pharm is aggressively pivoting from "Improved New Drugs" (IMD) to true innovation (First-in-Class), evidenced by an R&D intensity of 9.68% (KRW 18.57 billion).

The focal point remains HDNO-1605 (HD-6277), a GPR40 agonist for Type 2 Diabetes currently in Phase 2b clinical trials. While the GPR40 target has historically carried high development risks globally, success here would transition Hyundai Pharm from a domestic manufacturer to a global licensor. However, the company has strategically halted lower-priority projects (e.g., HDDO-1604) to funnel resources into this high-stakes asset and late-stage cardiovascular pipelines (HODO-2224, Phase 3).

Financial Health: The Liquidity Warning Light

Despite the operational turnaround, the balance sheet presents a "Grey Zone" risk profile that investors must monitor.

Cash Burn vs. Reserves: Cash and cash equivalents plummeted from KRW 10.2 billion to KRW 2.5 billion by the end of the 62nd period.

The Solvency Gap: With annual R&D expenditures nearing KRW 20 billion and liquid cash reserves critically low, the company’s current "organic" cash flow (even with improved profits) is insufficient to sustain the pipeline intensity for another 12 months without external intervention.

This divergence between Income Statement strength (Profitability) and Balance Sheet weakness (Liquidity) suggests that equity financing, convertible bonds, or asset liquidation may be imminent to bridge the gap until the next commercial milestone.

HDIN Viewpoint

> "Hyundai Pharmaceutical has successfully executed a commercial 'soft landing' for its key strategic assets, Slinda and DM Duo. The 2,218% profit increase is a validation of their product mix strategy, not a statistical anomaly.

> However, the company is approaching a critical financial junction. The aggressive pursuit of the HDNO-1605 clinical data has drained liquidity buffers. We assess the company is entering a period of high volatility where the 'So What' for investors is no longer about sales growth, but about capital efficiency. The immediate outlook depends on their ability to secure bridge financing without severely diluting shareholder value before the Phase 2b data readout re-rates the company's valuation."

Presentation Download

Want the full financial model and forecast?

Click the PDF download link under “Related Topics” to access the complete presentation of this report, including the detailed breakdown of the DM Duo revenue ramp-up and the Altman Z-Score risk assessment.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Hyundai Pharmaceutical 2025 Powering Health Through Innovation

The "First-Mover" Advantage: Margin Expansion over Volume

The "First-Mover" Advantage: Margin Expansion over VolumeThe 11% year-over-year growth in the pharmaceutical division (reaching KRW 159.8 billion) was not driven by legacy volume but by the successful commercialization of differentiated assets with high entry barriers.

Slinda (Progesterone-Only Pill): As Korea’s first estrogen-free contraceptive, Slinda has capitalized on a void in the market for patients sensitive to estrogen. By securing a monopoly in this specific therapeutic sub-segment, Hyundai Pharm has moved beyond price wars typical of the oral contraceptive market.

DM Duo (Donepezil + Memantine): Launching as the first domestic composite formulation for Alzheimer’s, DM Duo addresses compliance issues in elderly patients. By combining two standard-of-care mechanisms, the company secured premium reimbursement pricing, significantly lifting the gross margin profile compared to single-agent generics.

The Strategic Implication: The revenue contribution of these two assets alone is projected to reach KRW 15–20 billion in the next cycle. This confirms that the company’s strategy to optimize its portfolio structure—replacing low-margin products with exclusive modified drugs—is paying off.

R&D Pivot: The Cost of Ambition

Hyundai Pharm is aggressively pivoting from "Improved New Drugs" (IMD) to true innovation (First-in-Class), evidenced by an R&D intensity of 9.68% (KRW 18.57 billion).

The focal point remains HDNO-1605 (HD-6277), a GPR40 agonist for Type 2 Diabetes currently in Phase 2b clinical trials. While the GPR40 target has historically carried high development risks globally, success here would transition Hyundai Pharm from a domestic manufacturer to a global licensor. However, the company has strategically halted lower-priority projects (e.g., HDDO-1604) to funnel resources into this high-stakes asset and late-stage cardiovascular pipelines (HODO-2224, Phase 3).

Financial Health: The Liquidity Warning Light

Despite the operational turnaround, the balance sheet presents a "Grey Zone" risk profile that investors must monitor.

Cash Burn vs. Reserves: Cash and cash equivalents plummeted from KRW 10.2 billion to KRW 2.5 billion by the end of the 62nd period.

The Solvency Gap: With annual R&D expenditures nearing KRW 20 billion and liquid cash reserves critically low, the company’s current "organic" cash flow (even with improved profits) is insufficient to sustain the pipeline intensity for another 12 months without external intervention.

This divergence between Income Statement strength (Profitability) and Balance Sheet weakness (Liquidity) suggests that equity financing, convertible bonds, or asset liquidation may be imminent to bridge the gap until the next commercial milestone.

HDIN Viewpoint

> "Hyundai Pharmaceutical has successfully executed a commercial 'soft landing' for its key strategic assets, Slinda and DM Duo. The 2,218% profit increase is a validation of their product mix strategy, not a statistical anomaly.

> However, the company is approaching a critical financial junction. The aggressive pursuit of the HDNO-1605 clinical data has drained liquidity buffers. We assess the company is entering a period of high volatility where the 'So What' for investors is no longer about sales growth, but about capital efficiency. The immediate outlook depends on their ability to secure bridge financing without severely diluting shareholder value before the Phase 2b data readout re-rates the company's valuation."

Presentation Download

Want the full financial model and forecast?

Click the PDF download link under “Related Topics” to access the complete presentation of this report, including the detailed breakdown of the DM Duo revenue ramp-up and the Altman Z-Score risk assessment.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com