Bonfiglioli Transmissions IPO: A Proxy for India’s Industrial and Renewable CapEx Cycle

Date : 2026-02-21

Reading : 101

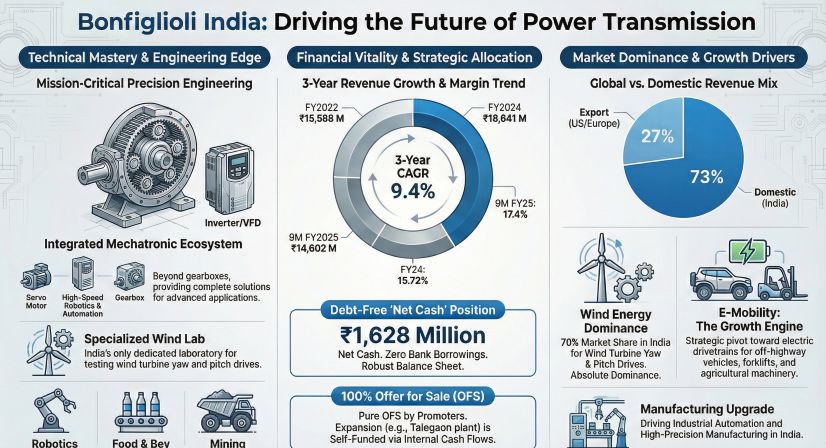

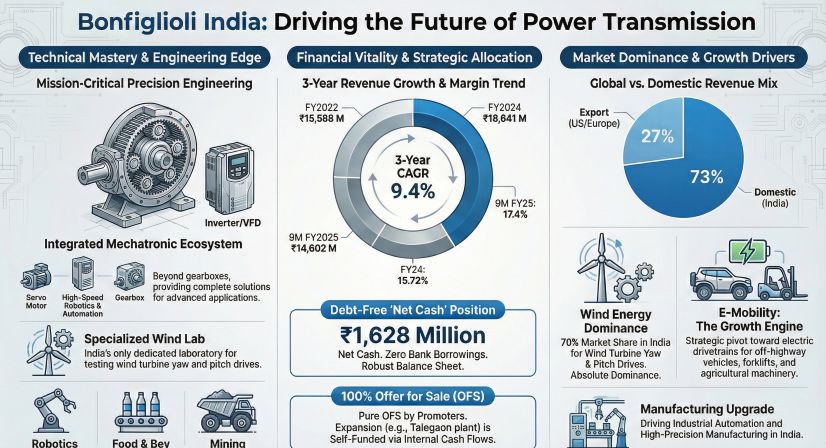

Bonfiglioli Transmissions Limited’s upcoming Initial Public Offering (IPO) is more than a liquidity event for its Italian parent; it unveils a debt-free industrial heavyweight commanding a near-monopoly in India’s wind energy sector. While the Offer for Sale (OFS) structure implies no fresh capital injection, the company’s "net cash" status and dominant market share present a compelling case for rigorous institutional analysis.

At HDIN Research, we have dissected the Draft Red Herring Prospectus (DRHP) to move beyond surface-level metrics. The data reveals a company that has successfully decoupled its growth from debt dependency, leveraging a "Glocal" (Global technology, Local execution) strategy to build high barriers to entry in mission-critical applications.

Figure Bonfiglioli India Driving the Future of Power Transmission

Market Hegemony in Mission-Critical Systems

Market Hegemony in Mission-Critical Systems

The strategic value of Bonfiglioli lies in its entrenched position across three distinct verticals: Wind, Off-Highway Mobility, and Industrial Automation.

The Wind Energy Moat: With an approximate 70% market share in yaw and pitch drives for wind turbines in India, Bonfiglioli effectively acts as a gatekeeper for the country’s renewable energy ambitions (targeting 107 GW by 2030). This is not merely a manufacturing advantage but a technological one; the company operates India’s only dedicated test lab for wind drives, creating a feedback loop that competitors struggle to replicate.

Sticky OEM Relationships: In the Off-Highway segment (30% share among non-captive suppliers), the company utilizes a "Co-engineering" model. By integrating into the client's R&D process up to 30 months before production, Bonfiglioli creates high switching costs. This deep integration protects its revenue streams from commoditization, evidenced by its long-standing relationships (10-20 years) with top OEMs.

A Fortress Balance Sheet Amidst CapEx Cycles

In a heavy manufacturing sector often plagued by leverage, Bonfiglioli stands out for its capital efficiency.

Zero-Debt Operations: As of the first nine months of FY2025, the company reported a negative net debt position of ₹1,628.29 million, effectively operating as a cash-generating machine. This allows the company to self-fund expansion—such as the new heavy-duty motor facility in Talegaon—without diluting shareholder value or incurring interest rate risks.

Operational Efficiency: Despite raw material costs accounting for ~63% of revenue, the company has expanded its EBITDA margins to 17.36% (9M FY25). This resilience is driven by a high localization rate (~70%), which insulates the bottom line from currency volatility and import tariffs that affect competitors relying on cross-border supply chains.

Structural Risks: Commodity Sensitivity and Parent Dependency

While the financial health is robust, the business model carries inherent structural risks that investors must price in.

Raw Material Pass-Through Lag: The company is highly sensitive to steel, aluminum, and cast iron prices. While OEM contracts include price escalation clauses, there is a time lag in implementation. During inflationary spikes, this delay can temporarily erode gross margins before pricing adjustments take effect.

The "Royalty" Reality: The company’s existence is tethered to its Italian parent, Bonfiglioli S.p.A., for brand rights and proprietary technology (Know-how). The IPO is an Offer for Sale (OFS), meaning 100% of proceeds exit the company. Investors are essentially buying into a localized execution engine that pays royalties for global IP, rather than funding new organic growth.

HDIN Research Viewpoint

HDIN Research views Bonfiglioli Transmissions as a high-quality "Play on India" asset. The company’s valuation should not be assessed solely on manufacturing multiples, but rather on its strategic positioning as a technological monopoly in the wind sector and a critical enabler of the "China + 1" supply chain shift.

However, the lack of primary capital infusion in this IPO suggests a mature asset securitization rather than a growth-capital raise. The investment thesis hinges on the continuity of the capex cycle in Indian infrastructure and the stability of the renewable energy policy framework. For institutional investors, the primary monitorable will be the company's ability to maintain its ROCE (~30%) as it expands into the competitive E-mobility sector.

Presentation Download

For a comprehensive breakdown of Bonfiglioli’s financial ratios, competitive benchmarking, and risk matrix, download our full analysis deck.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

At HDIN Research, we have dissected the Draft Red Herring Prospectus (DRHP) to move beyond surface-level metrics. The data reveals a company that has successfully decoupled its growth from debt dependency, leveraging a "Glocal" (Global technology, Local execution) strategy to build high barriers to entry in mission-critical applications.

Figure Bonfiglioli India Driving the Future of Power Transmission

Market Hegemony in Mission-Critical Systems

Market Hegemony in Mission-Critical SystemsThe strategic value of Bonfiglioli lies in its entrenched position across three distinct verticals: Wind, Off-Highway Mobility, and Industrial Automation.

The Wind Energy Moat: With an approximate 70% market share in yaw and pitch drives for wind turbines in India, Bonfiglioli effectively acts as a gatekeeper for the country’s renewable energy ambitions (targeting 107 GW by 2030). This is not merely a manufacturing advantage but a technological one; the company operates India’s only dedicated test lab for wind drives, creating a feedback loop that competitors struggle to replicate.

Sticky OEM Relationships: In the Off-Highway segment (30% share among non-captive suppliers), the company utilizes a "Co-engineering" model. By integrating into the client's R&D process up to 30 months before production, Bonfiglioli creates high switching costs. This deep integration protects its revenue streams from commoditization, evidenced by its long-standing relationships (10-20 years) with top OEMs.

A Fortress Balance Sheet Amidst CapEx Cycles

In a heavy manufacturing sector often plagued by leverage, Bonfiglioli stands out for its capital efficiency.

Zero-Debt Operations: As of the first nine months of FY2025, the company reported a negative net debt position of ₹1,628.29 million, effectively operating as a cash-generating machine. This allows the company to self-fund expansion—such as the new heavy-duty motor facility in Talegaon—without diluting shareholder value or incurring interest rate risks.

Operational Efficiency: Despite raw material costs accounting for ~63% of revenue, the company has expanded its EBITDA margins to 17.36% (9M FY25). This resilience is driven by a high localization rate (~70%), which insulates the bottom line from currency volatility and import tariffs that affect competitors relying on cross-border supply chains.

Structural Risks: Commodity Sensitivity and Parent Dependency

While the financial health is robust, the business model carries inherent structural risks that investors must price in.

Raw Material Pass-Through Lag: The company is highly sensitive to steel, aluminum, and cast iron prices. While OEM contracts include price escalation clauses, there is a time lag in implementation. During inflationary spikes, this delay can temporarily erode gross margins before pricing adjustments take effect.

The "Royalty" Reality: The company’s existence is tethered to its Italian parent, Bonfiglioli S.p.A., for brand rights and proprietary technology (Know-how). The IPO is an Offer for Sale (OFS), meaning 100% of proceeds exit the company. Investors are essentially buying into a localized execution engine that pays royalties for global IP, rather than funding new organic growth.

HDIN Research Viewpoint

HDIN Research views Bonfiglioli Transmissions as a high-quality "Play on India" asset. The company’s valuation should not be assessed solely on manufacturing multiples, but rather on its strategic positioning as a technological monopoly in the wind sector and a critical enabler of the "China + 1" supply chain shift.

However, the lack of primary capital infusion in this IPO suggests a mature asset securitization rather than a growth-capital raise. The investment thesis hinges on the continuity of the capex cycle in Indian infrastructure and the stability of the renewable energy policy framework. For institutional investors, the primary monitorable will be the company's ability to maintain its ROCE (~30%) as it expands into the competitive E-mobility sector.

Presentation Download

For a comprehensive breakdown of Bonfiglioli’s financial ratios, competitive benchmarking, and risk matrix, download our full analysis deck.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com