New DuPont 2025 Analysis: Strategic Purification and the Shift to Regulated Growth Markets

Date : 2026-02-21

Reading : 106

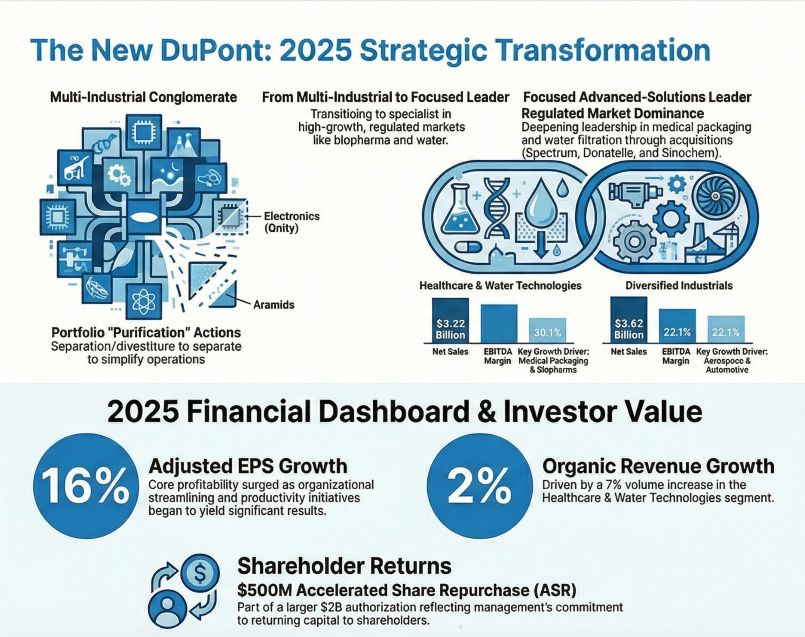

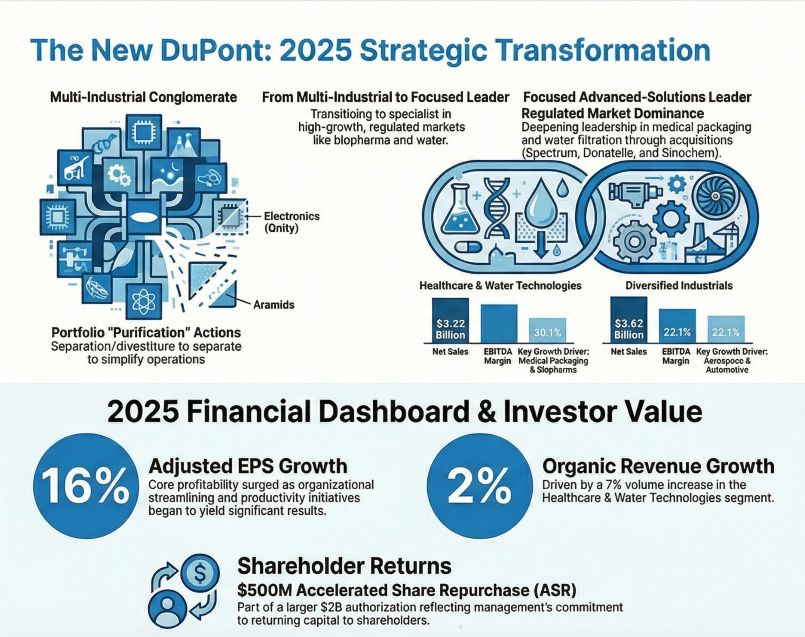

In a definitive year of structural realignment, DuPont de Nemours, Inc. has emerged from 2025 not merely as a smaller entity, but as a significantly more focused high-margin player. Following the divestiture of the Qnity electronics business and the classification of Aramids as discontinued operations, "New DuPont" reported net sales of $6.85 billion for its continuing operations—a 2% year-over-year increase.

However, the headline numbers belie a deeper strategic pivot. For institutional investors and industry observers, the critical narrative of 2025 is not just growth, but the quality of that growth. The company has successfully shifted its center of gravity from cyclical industrial commodities to secular, high-barrier "regulated markets" in healthcare and water technologies.

Figure The New DuPont 2025 Strategic Transformation

Financial Health: The Triumph of Productivity Over Pricing

Financial Health: The Triumph of Productivity Over Pricing

The "New DuPont" achieved an Operating EBITDA of $1.77 billion, reflecting a 5.3% increase year-over-year. More importantly, the Operating EBITDA margin expanded by 82 basis points to 25.9%.

HDIN Research analysis identifies a distinct shift in the drivers of this margin expansion. Unlike previous cycles driven by inflationary pricing power, 2025 was a story of operational discipline:

* Volume-Driven Growth: Net sales growth was propelled by a 3% increase in volume, which successfully offset a 1% drag from local price and product mix.

* The Productivity Engine: Approximately 70% of the margin improvement was attributed to aggressive cost productivity measures and restructuring initiatives (including the 2023-2024 plans), which neutralized inflationary pressures.

* Portfolio Uplift: The remaining 30% of margin expansion stemmed from the high-value mix injection from the Healthcare segment, proving that the portfolio "purification" is accretive to the bottom line.

Segment Divergence: Secular Tailwinds vs. Cyclical Headwinds

The divergence between DuPont’s two remaining core segments highlights the effectiveness of its strategic moat in regulated industries versus the exposure of its industrial legacy.

1. Healthcare & Water Technologies: The New Growth Engine

This segment has effectively decoupled from macroeconomic stagnation, delivering a 15% surge in Operating EBITDA to $972 million.

* Organic Growth: The segment recorded 7% organic volume growth, driven by robust demand in biopharma processing, medical packaging (Tyvek®), and medical devices.

* Strategic M&A Integration: The acquisitions of Spectrum Plastics and Donatelle have entrenched DuPont’s position in the highly regulated medical device value chain, creating high switching costs for customers.

* Water Resilience: Industrial and municipal water treatment demand, particularly in the APAC region, supported volume expansion, validated by the strategic acquisition of Sinochem Memtech.

2. Diversified Industrials: Navigating Construction Stagnation

Conversely, the Diversified Industrials segment faced cyclical headwinds, with Operating EBITDA declining by 5%. While aerospace and automotive (EV) applications provided pockets of growth, they were insufficient to fully counterbalance the persistent weakness in the Building Technologies sector, where volumes contracted due to a sluggish North American construction market.

Capital Allocation: Efficiency Amidst Transformation

2025 was a "cleaning" year for DuPont’s balance sheet. While reported operating cash flow (OCF) appeared suppressed at $560 million due to $460 million in transaction-related outflows (spinoff costs and rate swap settlements), the underlying capital efficiency remains robust.

* Liquidity Optimization: Post-divestiture, DuPont significantly improved its liquidity profile, raising its current ratio from 1.17 to 1.87.

* Shareholder Returns: The company aggressively returned capital, executing a $500 million Accelerated Share Repurchase (ASR) and maintaining a dividend payout, signaling management’s confidence in the firm's intrinsic value post-split.

HDIN Viewpoint: The "So What" for Strategy Leaders

At HDIN Research, we believe the market may be underappreciating the long-term implications of DuPont’s "purification" strategy. By shedding the volatile electronics cycle and the commoditized aramids business, DuPont has increased its exposure to "Regulated Markets"—sectors defined by long qualification cycles, high regulatory barriers, and sticky customer relationships.

While the $1.3 billion in non-cash impairments (related to Aramids and other assets) heavily impacted the GAAP net income for 2025, these are retrospective accounting adjustments. The prospective reality is that DuPont has secured a Transaction-Adjusted Free Cash Flow conversion rate of nearly 39%, with a clear pathway to exceed 50% as one-off separation costs dissipate in 2026.

The Strategic Watchlist:

Investors must monitor two countervailing forces in 2026:

1. The "Safety" Premium: Continued double-digit growth in Healthcare could command a higher valuation multiple.

2. The "Liability" overhang: The recurring PFAS legal settlements (e.g., the NJ settlement) and potential geopolitical friction in China (specifically regarding Tyvek® antitrust inquiries) remain the primary risks to the firm's otherwise pristine capital allocation strategy.

Download the Full Presentation

To dive deeper into the valuation models, segment-by-segment breakdowns, and our 2026 forecast for the specialty materials sector, please access the full report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

However, the headline numbers belie a deeper strategic pivot. For institutional investors and industry observers, the critical narrative of 2025 is not just growth, but the quality of that growth. The company has successfully shifted its center of gravity from cyclical industrial commodities to secular, high-barrier "regulated markets" in healthcare and water technologies.

Figure The New DuPont 2025 Strategic Transformation

Financial Health: The Triumph of Productivity Over Pricing

Financial Health: The Triumph of Productivity Over PricingThe "New DuPont" achieved an Operating EBITDA of $1.77 billion, reflecting a 5.3% increase year-over-year. More importantly, the Operating EBITDA margin expanded by 82 basis points to 25.9%.

HDIN Research analysis identifies a distinct shift in the drivers of this margin expansion. Unlike previous cycles driven by inflationary pricing power, 2025 was a story of operational discipline:

* Volume-Driven Growth: Net sales growth was propelled by a 3% increase in volume, which successfully offset a 1% drag from local price and product mix.

* The Productivity Engine: Approximately 70% of the margin improvement was attributed to aggressive cost productivity measures and restructuring initiatives (including the 2023-2024 plans), which neutralized inflationary pressures.

* Portfolio Uplift: The remaining 30% of margin expansion stemmed from the high-value mix injection from the Healthcare segment, proving that the portfolio "purification" is accretive to the bottom line.

Segment Divergence: Secular Tailwinds vs. Cyclical Headwinds

The divergence between DuPont’s two remaining core segments highlights the effectiveness of its strategic moat in regulated industries versus the exposure of its industrial legacy.

1. Healthcare & Water Technologies: The New Growth Engine

This segment has effectively decoupled from macroeconomic stagnation, delivering a 15% surge in Operating EBITDA to $972 million.

* Organic Growth: The segment recorded 7% organic volume growth, driven by robust demand in biopharma processing, medical packaging (Tyvek®), and medical devices.

* Strategic M&A Integration: The acquisitions of Spectrum Plastics and Donatelle have entrenched DuPont’s position in the highly regulated medical device value chain, creating high switching costs for customers.

* Water Resilience: Industrial and municipal water treatment demand, particularly in the APAC region, supported volume expansion, validated by the strategic acquisition of Sinochem Memtech.

2. Diversified Industrials: Navigating Construction Stagnation

Conversely, the Diversified Industrials segment faced cyclical headwinds, with Operating EBITDA declining by 5%. While aerospace and automotive (EV) applications provided pockets of growth, they were insufficient to fully counterbalance the persistent weakness in the Building Technologies sector, where volumes contracted due to a sluggish North American construction market.

Capital Allocation: Efficiency Amidst Transformation

2025 was a "cleaning" year for DuPont’s balance sheet. While reported operating cash flow (OCF) appeared suppressed at $560 million due to $460 million in transaction-related outflows (spinoff costs and rate swap settlements), the underlying capital efficiency remains robust.

* Liquidity Optimization: Post-divestiture, DuPont significantly improved its liquidity profile, raising its current ratio from 1.17 to 1.87.

* Shareholder Returns: The company aggressively returned capital, executing a $500 million Accelerated Share Repurchase (ASR) and maintaining a dividend payout, signaling management’s confidence in the firm's intrinsic value post-split.

HDIN Viewpoint: The "So What" for Strategy Leaders

At HDIN Research, we believe the market may be underappreciating the long-term implications of DuPont’s "purification" strategy. By shedding the volatile electronics cycle and the commoditized aramids business, DuPont has increased its exposure to "Regulated Markets"—sectors defined by long qualification cycles, high regulatory barriers, and sticky customer relationships.

While the $1.3 billion in non-cash impairments (related to Aramids and other assets) heavily impacted the GAAP net income for 2025, these are retrospective accounting adjustments. The prospective reality is that DuPont has secured a Transaction-Adjusted Free Cash Flow conversion rate of nearly 39%, with a clear pathway to exceed 50% as one-off separation costs dissipate in 2026.

The Strategic Watchlist:

Investors must monitor two countervailing forces in 2026:

1. The "Safety" Premium: Continued double-digit growth in Healthcare could command a higher valuation multiple.

2. The "Liability" overhang: The recurring PFAS legal settlements (e.g., the NJ settlement) and potential geopolitical friction in China (specifically regarding Tyvek® antitrust inquiries) remain the primary risks to the firm's otherwise pristine capital allocation strategy.

Download the Full Presentation

To dive deeper into the valuation models, segment-by-segment breakdowns, and our 2026 forecast for the specialty materials sector, please access the full report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com