Zojirushi FY25: Premium Strategy Drives 25% Profit Surge

Date : 2026-02-22

Reading : 99

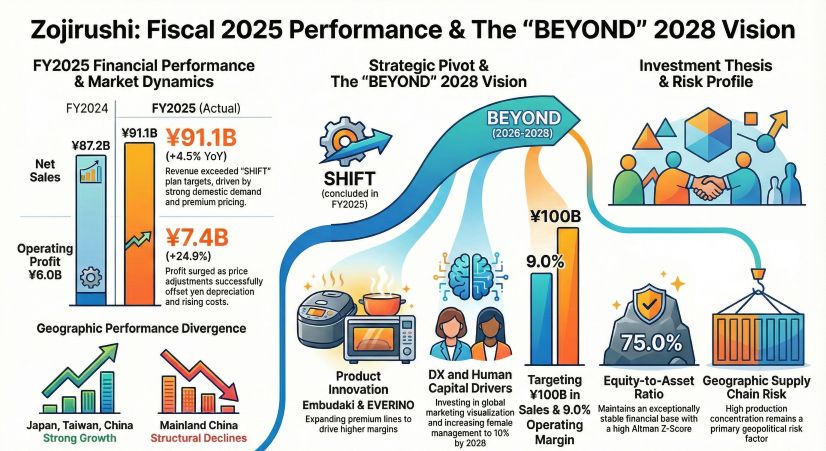

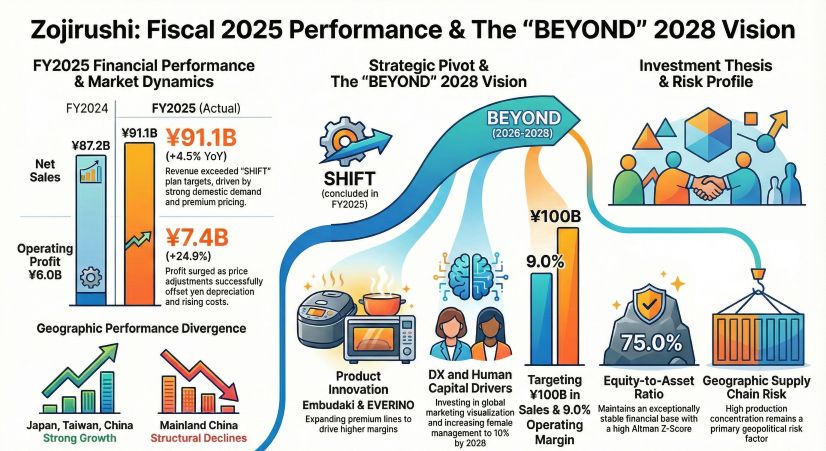

In an era defined by macroeconomic volatility and supply chain fragility, Zojirushi Corporation’s FY2025 financial performance underscores the resilience of a well-executed premiumization strategy. Despite intense currency headwinds and structural demand deceleration in key overseas markets, Zojirushi delivered a consolidated revenue of ¥91.15 billion (a 4.5% year-over-year increase) and an operating profit of ¥7.43 billion (a remarkable 24.9% surge). This performance reflects exceptional pricing elasticity; rather than yielding to volume-driven price wars, the company leveraged its technological differentiation to successfully pass import cost pressures onto the end market, thereby structurally defending its profit margins.

Financial Health: Pricing Elasticity and Capital Allocation Efficiency

Zojirushi’s ability to elevate its operating profit margin to 8.2% highlights the company's robust capital allocation efficiency. The "Cooking Appliances" segment remains the undeniable cash cow, accounting for 70.6% of total revenue at ¥64.38 billion (+5.2% YoY). Under the pressure of yen depreciation, which severely inflated the import costs of raw materials like stainless steel and copper, Zojirushi utilized its "Enbu Daki" pressure induction heating (IH) technology—achieving an unprecedented 1400W output—to solidify its premium market positioning. By maintaining a high-value, high-ticket pricing strategy, the company achieved a seamless price pass-through that directly translated into a fortified bottom line.

While ROE experienced a slight compression to 6.8% (down from 7.6%), this was largely a byproduct of an aggressive ¥3.4 billion share buyback program and a high base effect from a prior-year asset disposal. With a robust equity ratio of 75.0% and an Altman Z-Score positioned well within the safety threshold, Zojirushi's balance sheet maintains exceptional financial stability.

Figure Zojirushi Fiscal 2025 Performance & The Beyond 2028 Vision

Strategic Pivots: Transitioning to a Lifestyle Solutions Ecosystem

Strategic Pivots: Transitioning to a Lifestyle Solutions Ecosystem

Zojirushi is currently navigating a critical strategic pivot, transitioning its corporate identity from a traditional household goods manufacturer to a comprehensive "food and lifestyle solutions brand." This evolution is most evident in the "Household Appliances" segment, which emerged as the fiscal year's dark horse with a 36.7% revenue growth surge. Driven by robust demand for humidifiers, air purifiers, and dish dryers in Japan and Korea, this growth validates the company's horizontal category expansion.

Conversely, the "Living Products" segment encountered cyclical headwinds, experiencing a 9.4% revenue decline primarily due to sluggish stainless-steel product sales in China and Korea. Instead of resorting to margin-dilutive discounting, Zojirushi doubled down on its strategic moats. By introducing proprietary technologies like the "Seamless Sen" (integrated lid) and "Thermo Ring," the company focused on resolving user pain points around maintenance, opting for a highly differentiated pricing logic over a commoditized volume strategy.

Sector Positioning: Regional Divergence and Channel Restructuring

Zojirushi’s global footprint revealed stark regional divergences in FY2025. Domestic sales in Japan proved highly resilient, growing 10.1% to ¥61.44 billion, propelled by premium models like the "EVERINO" oven range. However, overseas markets declined by 5.4%, bringing international revenue dependency down to 32.6%.

This overseas contraction was predominantly catalyzed by macroeconomic headwinds in the Chinese market. Prolonged stagnation in China’s real estate sector fundamentally suppressed consumer demand for durable household upgrades. Furthermore, heightened local competition and shifting consumer sentiment severely impacted Zojirushi's high-margin aesthetic products. In response, Zojirushi is accelerating its direct-to-consumer (DTC) and e-commerce channel restructuring. The 100% acquisition of Hong Kong-based Lin & Partners Distributors Limited in September 2025 signifies a decisive move to consolidate channel control, clear structural bottlenecks, and re-establish brand authority in Southern China and Southeast Asia.

HDIN Viewpoint

From an institutional perspective, HDIN Research views Zojirushi’s FY2025 results as a masterclass in margin preservation during an inflationary cycle. The company's strategic moats—built on deep technological intellectual property and immense brand equity—have created an inelastic demand curve for its top-tier products.

Looking forward to the "BEYOND" mid-term plan (2026-2028), targeting ¥100 billion in revenue and a 9.0% operating margin, investors must monitor two critical risk vectors. First, geopolitical supply chain vulnerabilities: with manufacturing highly concentrated at the Xin Xiang plant in Shenzhen, Zojirushi faces structural exposure to potential U.S.-China trade tariffs. To mitigate this, high inventory days (currently estimated at 151.5 days) function as a temporary buffer, though they carry long-term holding costs. Second, the effectiveness of its Asian channel overhaul. Whether the newly established South Korean subsidiary and the integrated Hong Kong operations can effectively reverse the regional growth deceleration will ultimately dictate if Zojirushi can successfully capture its next phase of global market share.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Financial Health: Pricing Elasticity and Capital Allocation Efficiency

Zojirushi’s ability to elevate its operating profit margin to 8.2% highlights the company's robust capital allocation efficiency. The "Cooking Appliances" segment remains the undeniable cash cow, accounting for 70.6% of total revenue at ¥64.38 billion (+5.2% YoY). Under the pressure of yen depreciation, which severely inflated the import costs of raw materials like stainless steel and copper, Zojirushi utilized its "Enbu Daki" pressure induction heating (IH) technology—achieving an unprecedented 1400W output—to solidify its premium market positioning. By maintaining a high-value, high-ticket pricing strategy, the company achieved a seamless price pass-through that directly translated into a fortified bottom line.

While ROE experienced a slight compression to 6.8% (down from 7.6%), this was largely a byproduct of an aggressive ¥3.4 billion share buyback program and a high base effect from a prior-year asset disposal. With a robust equity ratio of 75.0% and an Altman Z-Score positioned well within the safety threshold, Zojirushi's balance sheet maintains exceptional financial stability.

Figure Zojirushi Fiscal 2025 Performance & The Beyond 2028 Vision

Strategic Pivots: Transitioning to a Lifestyle Solutions Ecosystem

Strategic Pivots: Transitioning to a Lifestyle Solutions EcosystemZojirushi is currently navigating a critical strategic pivot, transitioning its corporate identity from a traditional household goods manufacturer to a comprehensive "food and lifestyle solutions brand." This evolution is most evident in the "Household Appliances" segment, which emerged as the fiscal year's dark horse with a 36.7% revenue growth surge. Driven by robust demand for humidifiers, air purifiers, and dish dryers in Japan and Korea, this growth validates the company's horizontal category expansion.

Conversely, the "Living Products" segment encountered cyclical headwinds, experiencing a 9.4% revenue decline primarily due to sluggish stainless-steel product sales in China and Korea. Instead of resorting to margin-dilutive discounting, Zojirushi doubled down on its strategic moats. By introducing proprietary technologies like the "Seamless Sen" (integrated lid) and "Thermo Ring," the company focused on resolving user pain points around maintenance, opting for a highly differentiated pricing logic over a commoditized volume strategy.

Sector Positioning: Regional Divergence and Channel Restructuring

Zojirushi’s global footprint revealed stark regional divergences in FY2025. Domestic sales in Japan proved highly resilient, growing 10.1% to ¥61.44 billion, propelled by premium models like the "EVERINO" oven range. However, overseas markets declined by 5.4%, bringing international revenue dependency down to 32.6%.

This overseas contraction was predominantly catalyzed by macroeconomic headwinds in the Chinese market. Prolonged stagnation in China’s real estate sector fundamentally suppressed consumer demand for durable household upgrades. Furthermore, heightened local competition and shifting consumer sentiment severely impacted Zojirushi's high-margin aesthetic products. In response, Zojirushi is accelerating its direct-to-consumer (DTC) and e-commerce channel restructuring. The 100% acquisition of Hong Kong-based Lin & Partners Distributors Limited in September 2025 signifies a decisive move to consolidate channel control, clear structural bottlenecks, and re-establish brand authority in Southern China and Southeast Asia.

HDIN Viewpoint

From an institutional perspective, HDIN Research views Zojirushi’s FY2025 results as a masterclass in margin preservation during an inflationary cycle. The company's strategic moats—built on deep technological intellectual property and immense brand equity—have created an inelastic demand curve for its top-tier products.

Looking forward to the "BEYOND" mid-term plan (2026-2028), targeting ¥100 billion in revenue and a 9.0% operating margin, investors must monitor two critical risk vectors. First, geopolitical supply chain vulnerabilities: with manufacturing highly concentrated at the Xin Xiang plant in Shenzhen, Zojirushi faces structural exposure to potential U.S.-China trade tariffs. To mitigate this, high inventory days (currently estimated at 151.5 days) function as a temporary buffer, though they carry long-term holding costs. Second, the effectiveness of its Asian channel overhaul. Whether the newly established South Korean subsidiary and the integrated Hong Kong operations can effectively reverse the regional growth deceleration will ultimately dictate if Zojirushi can successfully capture its next phase of global market share.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com