Rays of Belief IPO Analysis: Strategic Moats in NDD Care

Date : 2026-02-22

Reading : 91

The global Neurodevelopmental Disorders (NDDs) rehabilitation market has historically been constrained by extreme fragmentation, capacity bottlenecks, and artisanal care models. However, Rays of Belief Limited (operating under the brand "Mom's Belief") is fundamentally disrupting this paradigm. As India’s largest and the world’s seventh-largest for-profit social enterprise providing NDD intervention, the company’s impending IPO warrants rigorous institutional scrutiny. HDIN Research's proprietary analysis reveals that the company's asset-light expansion strategy and cross-border M&A are driving significant operational efficiency, though its aggressive capital allocation must navigate inherent clinical talent bottlenecks and regulatory thresholds.

Sector Positioning: The Asset-Light Strategic Moat

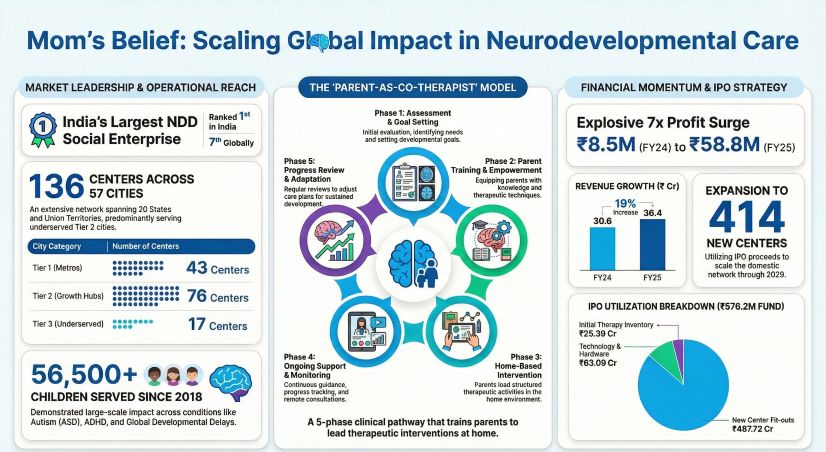

Mom’s Belief has successfully transitioned NDD therapy from a fragmented, practitioner-dependent service into a standardized, scalable business model. By implementing a centralized five-stage care protocol across its 136 centers in India, the company ensures clinical consistency while mitigating the key-person risk typically associated with independent therapy clinics.

Strategically, the company has bypassed the saturated Tier-1 metropolitan markets to aggressively penetrate Tier-2 and Tier-3 cities. This geographical pivot is not merely about market share; it is a calculated play on capital allocation efficiency. By exploiting the pronounced "medical vacuum" in these underserved regions, Mom's Belief benefits from significantly lower real estate and operational costs. Operating entirely on short-term leases (11 months to 3 years) rather than heavy real estate acquisitions, the company has compressed its unit economics, achieving a rapid breakeven cycle of just 8 to 12 months per center.

Furthermore, its B2B2C acquisition channel—partnering with over 100 licensed pediatricians and establishing in-school collaborative centers—structurally lowers Customer Acquisition Cost (CAC), transforming pediatricians from independent practitioners into highly efficient referral nodes.

Figure Mom's Belief Scaling Global lmpact in Neurodevelopmental Care

Financial Health: Growth Engines and Structural Misalignments

Financial Health: Growth Engines and Structural Misalignments

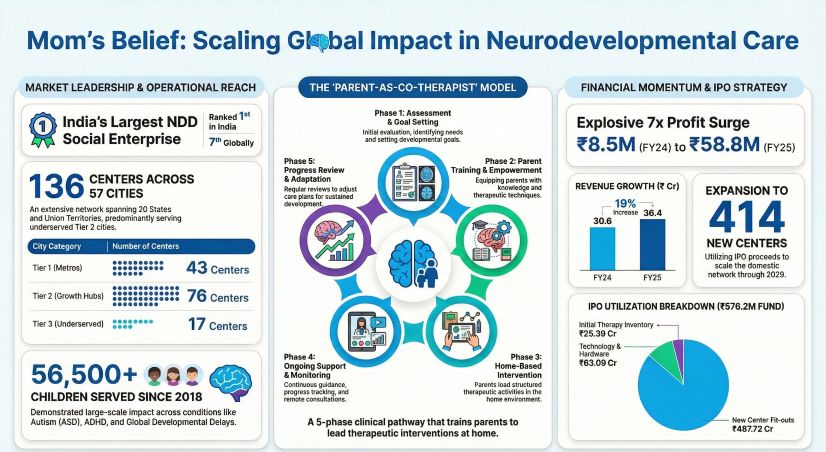

From a financial perspective, Rays of Belief exhibits a classic "high-growth, volatile-profitability" profile. Revenue surged by 38.30% in FY24 and continued to compound into FY26, heavily augmented by the strategic acquisition of Mom's Belief US Inc. This inorganic leap into the mature United States allergy and immunology market provides a synergistic pipeline to cross-sell NDD behavioral interventions to an established pediatric client base.

Operational efficiency is clearly visible in the company's EBITDA margin, which expanded from 4.87% in FY24 to a robust 10.08% in H1 FY26. A highly conservative Debt-to-Equity ratio of 0.17 provides substantial unencumbered leverage, offering a massive runway to fund its ambitious pipeline of 414 new centers.

However, HDIN Research notes a structural misalignment in earnings quality. The dramatic Profit After Tax (PAT) spike in FY25 was heavily inflated by non-cash deferred tax credits, and operating cash flows remain negative. This liquidity drag is primarily tethered to a high concentration of related-party transactions—nearly 40% of FY25 revenue stemmed from export services to its Singaporean parent, manifesting as delayed receivables rather than liquid capital.

Cyclical Headwinds and Valuation Paradigm

As the company approaches the public markets, traditional Price-to-Earnings (P/E) multiples are inadequate for accurate institutional pricing. The adoption of Ind AS 116 (which distorts net income via lease liabilities) and heavy upfront depreciation dictate that EV/EBITDA is the superior valuation metric. Investors should benchmark Mom's Belief against global behavioral health leaders such as LifeStance Health Group and Acadia Healthcare, adjusting for emerging market risk premiums.

The most critical cyclical headwinds facing the enterprise are talent supply chain constraints and regulatory compliance. The NDD sector suffers from a systemic shortage of specialized clinical talent. With clinical turnover rates hovering around 4.51%, escalating compensation costs threaten to compress future margins. Additionally, maintaining its formal status as a "For-Profit Social Enterprise" (FPSE) requires strict adherence to regulatory quotas, dictating that 67% of its activities must target underserved demographics—a rigid compliance ceiling that could complicate future commercial pivots.

HDIN Viewpoint

HDIN Research views Rays of Belief as a pioneering force capable of capturing profound alpha in the structurally underserved NDD market. Their core competency lies not just in therapeutic intervention, but in their proprietary "industrialization" of care delivery. The low-CAC B2B2C funnel combined with an omnichannel (offline centers plus e-therapy) approach generates a high Lifetime Value (LTV) per patient. While the US expansion injects a premium growth narrative, long-term valuation sustainability will hinge entirely on the company's ability to normalize its operating cash flows, diversify away from related-party revenue dependencies, and institutionalize its clinical talent pipeline.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Sector Positioning: The Asset-Light Strategic Moat

Mom’s Belief has successfully transitioned NDD therapy from a fragmented, practitioner-dependent service into a standardized, scalable business model. By implementing a centralized five-stage care protocol across its 136 centers in India, the company ensures clinical consistency while mitigating the key-person risk typically associated with independent therapy clinics.

Strategically, the company has bypassed the saturated Tier-1 metropolitan markets to aggressively penetrate Tier-2 and Tier-3 cities. This geographical pivot is not merely about market share; it is a calculated play on capital allocation efficiency. By exploiting the pronounced "medical vacuum" in these underserved regions, Mom's Belief benefits from significantly lower real estate and operational costs. Operating entirely on short-term leases (11 months to 3 years) rather than heavy real estate acquisitions, the company has compressed its unit economics, achieving a rapid breakeven cycle of just 8 to 12 months per center.

Furthermore, its B2B2C acquisition channel—partnering with over 100 licensed pediatricians and establishing in-school collaborative centers—structurally lowers Customer Acquisition Cost (CAC), transforming pediatricians from independent practitioners into highly efficient referral nodes.

Figure Mom's Belief Scaling Global lmpact in Neurodevelopmental Care

Financial Health: Growth Engines and Structural Misalignments

Financial Health: Growth Engines and Structural MisalignmentsFrom a financial perspective, Rays of Belief exhibits a classic "high-growth, volatile-profitability" profile. Revenue surged by 38.30% in FY24 and continued to compound into FY26, heavily augmented by the strategic acquisition of Mom's Belief US Inc. This inorganic leap into the mature United States allergy and immunology market provides a synergistic pipeline to cross-sell NDD behavioral interventions to an established pediatric client base.

Operational efficiency is clearly visible in the company's EBITDA margin, which expanded from 4.87% in FY24 to a robust 10.08% in H1 FY26. A highly conservative Debt-to-Equity ratio of 0.17 provides substantial unencumbered leverage, offering a massive runway to fund its ambitious pipeline of 414 new centers.

However, HDIN Research notes a structural misalignment in earnings quality. The dramatic Profit After Tax (PAT) spike in FY25 was heavily inflated by non-cash deferred tax credits, and operating cash flows remain negative. This liquidity drag is primarily tethered to a high concentration of related-party transactions—nearly 40% of FY25 revenue stemmed from export services to its Singaporean parent, manifesting as delayed receivables rather than liquid capital.

Cyclical Headwinds and Valuation Paradigm

As the company approaches the public markets, traditional Price-to-Earnings (P/E) multiples are inadequate for accurate institutional pricing. The adoption of Ind AS 116 (which distorts net income via lease liabilities) and heavy upfront depreciation dictate that EV/EBITDA is the superior valuation metric. Investors should benchmark Mom's Belief against global behavioral health leaders such as LifeStance Health Group and Acadia Healthcare, adjusting for emerging market risk premiums.

The most critical cyclical headwinds facing the enterprise are talent supply chain constraints and regulatory compliance. The NDD sector suffers from a systemic shortage of specialized clinical talent. With clinical turnover rates hovering around 4.51%, escalating compensation costs threaten to compress future margins. Additionally, maintaining its formal status as a "For-Profit Social Enterprise" (FPSE) requires strict adherence to regulatory quotas, dictating that 67% of its activities must target underserved demographics—a rigid compliance ceiling that could complicate future commercial pivots.

HDIN Viewpoint

HDIN Research views Rays of Belief as a pioneering force capable of capturing profound alpha in the structurally underserved NDD market. Their core competency lies not just in therapeutic intervention, but in their proprietary "industrialization" of care delivery. The low-CAC B2B2C funnel combined with an omnichannel (offline centers plus e-therapy) approach generates a high Lifetime Value (LTV) per patient. While the US expansion injects a premium growth narrative, long-term valuation sustainability will hinge entirely on the company's ability to normalize its operating cash flows, diversify away from related-party revenue dependencies, and institutionalize its clinical talent pipeline.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com